Save for a house deposit

Buying a house is exciting and life changing. It all starts with saving for the deposit. Find out how much you’ll need to save and

Buying a house is exciting and life changing. It all starts with saving for the deposit. Find out how much you’ll need to save and

A critical illness or serious injury can make it difficult to continue to work. Trauma insurance can help support you and your family at this time

What it means to combine finances Even if you have a strong relationship, there are some important details to consider before joining finances. Money Smart’s guide

These three common mistakes are easy to avoid. Making them could be costly. Sharp downturns on global financial markets are always unsettling. Recently and largely

Think of your finances like your home: how its foundations are built and maintained determines its ability to stand strong for years to come. Money

A ‘transition to retirement’ (TTR) strategy lets you access some of your super and keep working. Setting this up can be complicated, so contact your

Many Australians expect an inheritance, but their parents may have a different view. Around one in two Australians have received or expect to inherit money

The tax cuts introduced from July 1 and other changes may mean it’s time for a review of your current tax, super and investment strategies

Binary options promise quick, high returns. But the reality is you will lose your entire investment most of the time. Binary options are financial products

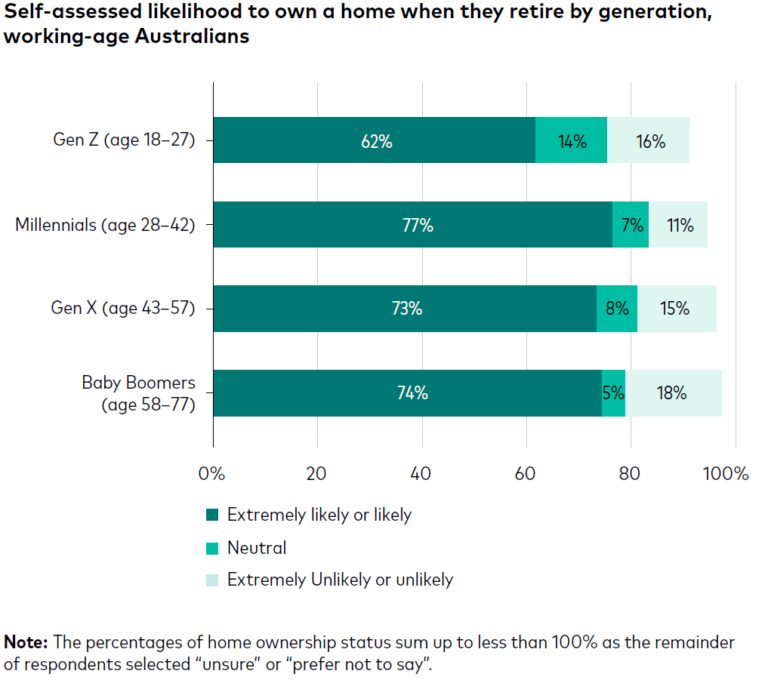

Retiring without a mortgage has a large positive impact on retirement confidence. For decades the “Great Australian Dream” has been the general desire by most

Gold prices have been climbing strongly in 2024 as investors, jittery about the effects of wars in the Middle East and Ukraine, buy up the

Key points: Getting an assessment is the first step towards getting access to Government funded services Assessments are undertaken by the Aged Care Assessment Team